This exceeds the deficits for the entire year of 2024 ($38.6 billion) and 2023 ($37.9 billion). Against the backdrop of such explosive growth in the deficit, a discussion has unfolded about the prospects for the exchange rate. After all, under conditions of rapid expansion of the external imbalance, the hryvnia exchange rate should usually correct.

To understand whether devaluation can help remedy the situation, it is worth figuring out what caused this deficit to form and grow so rapidly.

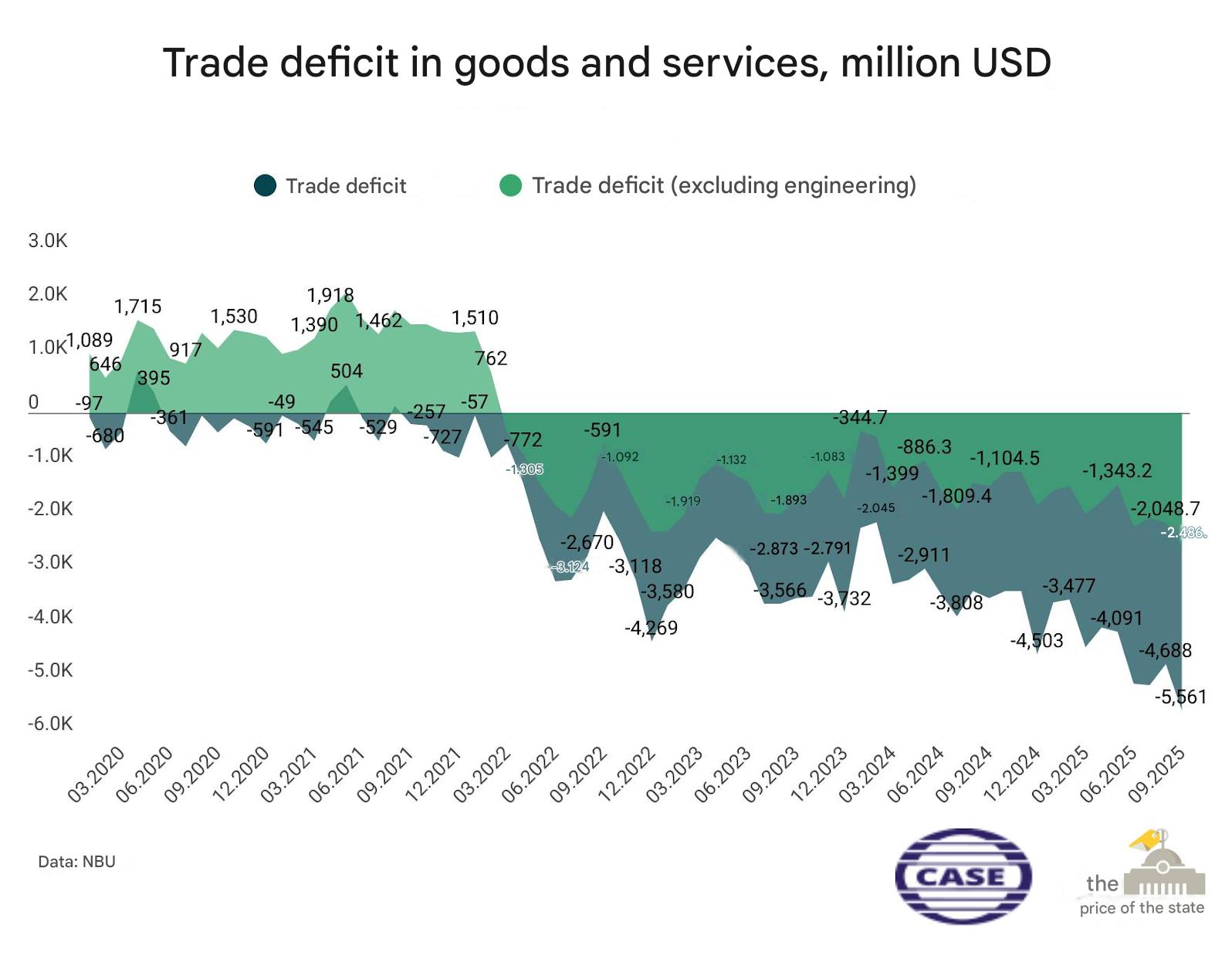

If we trace the history of its rapid expansion over the past three years, two key trends come to the fore:

— exports of agricultural products, which in recent years have accounted for more than 60% of total merchandise exports;

— imports of machinery, which account for more than half of the increase in merchandise imports.

In fact, the 2025 trade deficit explosion was caused by an increase in imports of engineering products — primarily energy equipment and, notably, dual-use products — against the backdrop of a decline in agricultural exports due to the poor harvest in 2024.

In particular, during the first nine months of this year, the trade deficit in goods increased by $12.2 billion, of which $11.1 billion is attributable to the rise in imports, while the decline in exports accounts for only $1.1 billion of the deficit’s increase.

If we focus on the fact that $6.2 billion of the increase in imports ($11.1 billion for the first nine months of 2025) falls under the category of “Machinery, equipment, vehicles, and appliances,” and the lion’s share of this is energy equipment or dual-use products (power generation equipment), then the lion’s share of this is energy equipment or dual-use products (power generation equipment). 2025) falls under the category of “Machinery, equipment, vehicles, and appliances.”

The lion’s share of this is energy equipment or dual-use products (supplies of weapons and ammunition are not reflected in the statistics). One can agree with the argument that the weakening of the hryvnia will not have a significant impact. After all, farmers will not start producing and exporting more “tomorrow” and the “purchase of energy equipment remains necessary due to constant attacks on infrastructure. There is no need to mention dual-use products.

However, there are several essential nuances that supporters of national currency stability often overlook:

1. Growth in consumer imports.

In addition to imports caused by the war, various consumer imports are experiencing active growth. This is most clearly seen in the dynamics of food imports (remember Polish cheese, milk, butter, etc. on store shelves) — there is no “dual use” here: food products in Ukraine have become more expensive than in neighboring countries. Against this backdrop, the rapid growth in imports under the heading “Miscella” eous” after 2 “22 is indicative, which, according to the NBU, also reflects the assessment of informal imports.

2. Partners finance imports of energy equipment.

A significant portion of these imports is financed by our international partners, who support us with currency, thereby reducing our dependence on potential exchange rate fluctuations. These funds will have to be repaid at some point, but by then the hryvnia exchange rate will undoubtedly be different. In other words, the exchange rate correction will have little impact on the purchase of energy equipment.

3. Uncertainty about the inflow of investments.

The scenario of an explosive inflow of private investments after the end of active hostilities currently seems unlikely. Moreover, the inflow of funds for reconstruction from frozen Russian assets is taking a back seat, as this money is likely to be used to support current budgetary and defense needs (although the decision has not yet been made, there is every reason to hope for this).

Therefore, government policy should be based on more realistic scenarios and take into account the risks of a delayed influx of private investment. It is thus necessary to prepare for a gradual correction of the exchange rate (in simple terms, a fall in the hryvnia) after the end of the active phase of the war.

In summary, the devaluation of the hryvnia will not resolve the trade deficit problem, as the lion’s share of the war is responsible for it. However, the current currency policy actually subsidizes the growth of consumer imports, while large volumes of foreign exchange earnings are temporary and will decline over time.

Shock devaluation is certainly not acceptable in the current circumstances (nor is it necessary given the size of foreign exchange reserves).

However, a return to the policy of gradual, controlled exchange rate adjustments, which the National Bank practiced at the end of 2023 and in the first half of 2024, is entirely justified within the logic of maintaining the attractiveness of hryvnia assets.

Greater flexibility in exchange rate formation will minimize the risks of a sharp transition to market realities in the future.