This is evidenced by the study “Comparative Analysis of the Fiscal Effect of the Use of Tax Evasion/Avoidance Instruments in Ukraine”, conducted by the Institute for Social and Economic Transformation, CASE Ukraine and the Economic Expert Platform in cooperation with the Center for International Private Enterprise CIPE Ukraine.

According to the previous study, losses from tax evasion schemes amounted to UAH 250-400 billion annually.

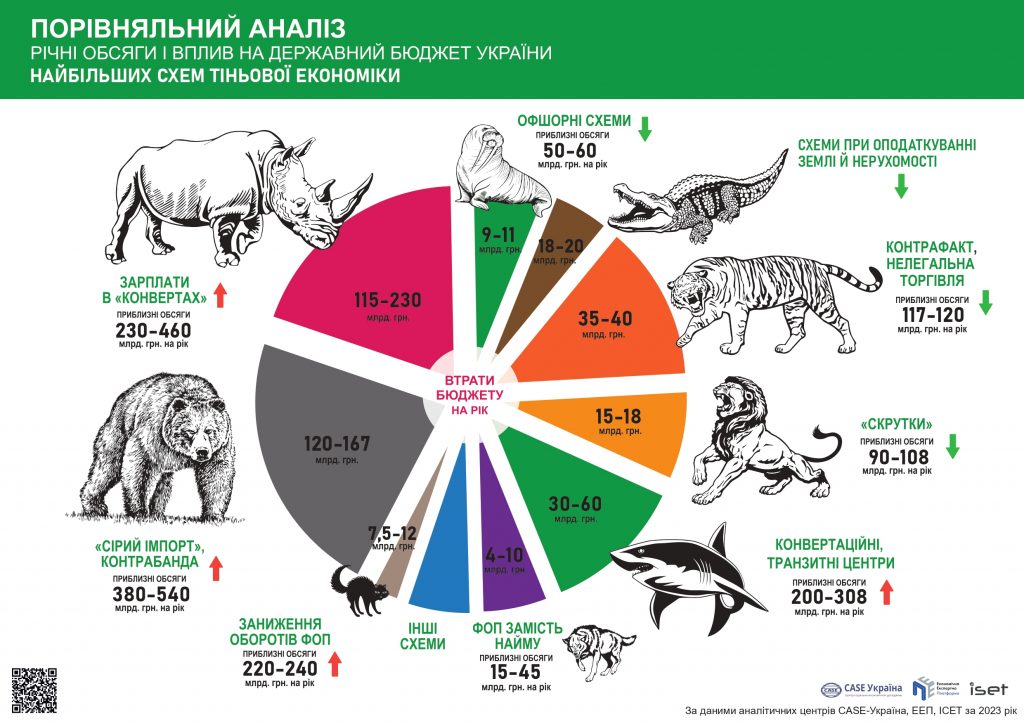

Among the existing schemes, the leader in terms of growth is “gray” imports and smuggling: budget losses increased from UAH 80-150 billion to UAH 120-167 billion in 2023. The second is the “salaries in envelopes” scheme – UAH 115-230 billion.

The scheme of “conversion and/or transit centers, tax holes, misdirection, drops” has significantly increased: in the previous analysis for 2022, budget losses amounted to UAH 20-30 billion per year, while now they are UAH 30-60 billion per year.

Positive trends include decreased losses from the “counterfeiting, illegal trade” scheme from UAH 46-51 billion to UAH 35-40 billion. There is a moderate decrease in the scheme of “formation of a tax credit (fraud)” – from UAH 16-20 billion to UAH 15-18 billion.

It is noteworthy that losses from individual entrepreneurs, who are often blamed for budget losses, total UAH 11.5-22 billion: FOPs instead of hiring Group 3 and “cash-in” – UAH 4-10 billion; underreporting of FOP turnover – UAH 7.5-12 billion.

According to the authors, the tax avoidance structure has not remained unchanged. Structural changes, legislative amendments, war, economic crisis and other factors have led to an increase in the volume of abuse of specific schemes (conversion and transit centers (tax holes, misdirection, drops); salaries “in envelopes”; violation of customs rules, smuggling and corruption at the border), while reducing abuses in other schemes (primarily offshore schemes and BEPS, as well as VAT “twists”, schemes using the simplified taxation system, schemes in the agricultural sector).

The “leader” among the most significant tax minimization schemes – “smuggling and gray imports” – has been retained.

Offshore schemes and cross-border profit shifting, as a result of the war, currency restrictions and high upward cost of service caused by new global standards of tax transparency (anti-BEPS, FATCA, ATAD, BEPS 2.0, CFC and others), are increasingly becoming “elitist,” i.e., they remain available to large Ukrainian companies and wealthy Ukrainians. The volume of profit shifting abroad is at a historically low level.

According to the authors, the general recommendation for all chapters is to continue and complete judicial reform, institutional reform of the customs service and tax service – recruiting employees in open competitions with the decisive vote of international experts and providing decent salaries.

In addition, we believe it is essential to strengthen further the institution of control over transfer pricing (TP) and CFCs (controlled foreign companies), to create a single data center with all tax and customs information within the Ministry of Finance or an independent aggregator under its auspices.

P.S. The study results were presented on October 18, 2024 at the forum “Dialogue of Civil Society, Business and Government: Inclusive Institutions and Economic Freedoms”, organized by the Ukrainian Business Council and the National Business Coalition. The research will be published later on the Institute for Social and Economic Transformation websites, the Economic Expert Platform and CASE Ukraine.