Minister of Finance Serhiy Marchenko has repeatedly emphasized publicly that none of the new measures from the National Strategy will be implemented until the fiscal authorities improve their own trustworthiness. The strategy itself includes a dedicated section, 4.2.1(b), titled ‘Increasing Public Trust and Creating a Positive Image of the State Tax Service.’ This section outlines a series of measures and establishes a framework for regularly assessing the impact of these initiatives.

Interestingly, when drafting the National Strategy, fiscal officials were influenced by survey results suggesting that public trust in the fiscal authorities ranged from 64% to 75%. Notably, the strategy itself states:

‘According to the independent Global Survey on Taxpayers’ Presception of the State Tax Service’s Activities conducted in 2022, the general attitude of both the public and businesses toward the State Tax Service is positive: between 64% and 75% of respondents trust its professionalism and integrity. At the same time, 7% to 15% of respondents express complete distrust in the State Tax Service, highlighting existing challenges in taxpayer interactions and their impact on overall trust in the tax authority. ‘

In other words, based on the aforementioned survey, fiscal authorities, when drafting the National Strategy, believed that trust in their work was generally high, with only 7% to 15% of respondents expressing distrust in the State Tax Service for certain reasons. This suggests that, overall, the situation is positive for the fiscal authorities, though some aspects need improvement to reach the desired level of trust—an outcome the Ministry of Finance considered achievable within the next few years.

To understand what the 64% to 75% trust in fiscal authorities mentioned in the National Strategy actually represents, one must look at the Global Survey on Taxpayers’ Perception of the State Tax Service’s Activities. Firstly, there is the issue of sample composition, as the survey primarily targeted the general population (4,685 respondents), nearly five times more than the number of business representatives surveyed (1,006 respondents). Secondly, the wording of the questions matters. The statements that received such positive responses were phrased as follows:

- I believe the responses I receive from the Tax Office are accurate.

- Tax Office employees explain how I can resolve my issues.

- Tax Office employees listen to me and understand my concerns.

- Tax Office employees treat me fairly.

- It is easy to contact the Tax Office.

- Tax Office employees trust that I intend to comply with regulations.

Thirdly, there is the overall context of the survey. The majority of the questions focus on the convenience of electronic services available to respondents (4,685 citizens and 1,006 business representatives) for filing reports and paying taxes. As a result, most of the questions in the 2022 survey are interpreted specifically within the context of electronic services. Furthermore, the vast majority of responses come from citizens who have never had direct interactions with the tax office.

Several shortcomings of the 2022 Global Survey were addressed in the World Bank’s 2024 survey. As it turned out, trust in fiscal authorities is not as high as the Ministry of Finance had assumed based on the findings of the e-services survey. According to the World Bank report ‘Ukraine: 2024 Tax Compliance Cost Survey,’ trust in the fairness of tax authorities remains low: only 7.8% of respondents completely agree that tax authorities are fair, while 48.9% disagree with this statement. In other words, the supposed ‘64% to 75%’ level of trust in fiscal authorities is nowhere to be found.

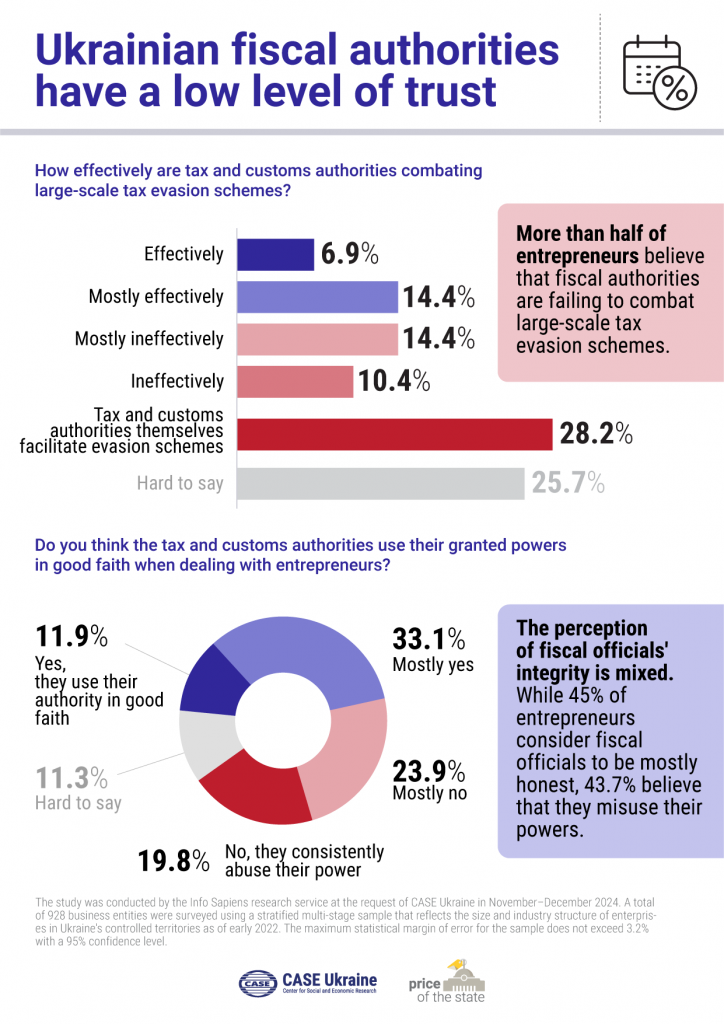

The results of a survey conducted by the research service InfoSapiens on behalf of CASE Ukraine in November–December 2024 also confirm that there is a lack of trust in fiscal authorities. According to the data obtained, more than half of the surveyed entrepreneurs believe that fiscal authorities are ineffective in combating large-scale tax evasion schemes. The assessment of their integrity is mixed: 45% of entrepreneurs consider fiscal authorities to be mostly honest, while 43.7% believe they misuse the powers granted to them. Interestingly, these findings align with the results of the State Tax Service’s own 2022 Global Survey, in which about 40% of respondents stated that the agency effectively combats tax evasion, while the rest either disagreed with this statement or were unable to provide an answer.

In other words, the National Revenue Strategy until 2030 was developed by the Ministry of Finance based on an inaccurate assessment of the actual situation and an overly optimistic portrayal of public trust in fiscal authorities. This distorted perception is so disconnected from reality that the National Strategy even included plans to evaluate the effectiveness of trust-building measures already in 2024. However, as we can see, something went wrong. A new survey by the World Bank and CASE Ukraine has debunked the illusion upon which the National Revenue Strategy until 2030 was built.

The Ministry of Finance now has two options: either attempt to achieve the overly ambitious goal set by the National Strategy over the next five years—despite the fact that 28.2% of entrepreneurs believe fiscal authorities themselves facilitate tax evasion schemes, and 19.8% think they consistently abuse their powers—or acknowledge reality and revise the National Strategy, as both the business community and public organizations are demanding. Otherwise, the strategy will remain nothing more than a dead document.