In April CASE Ukraine think tank held a discussion Financial System of Ukraine in Wartime Setting. Are Banks Ready to Lend? The event featured deputy NBU Governor Serghiy Nikolaychuk, CASE Ukraine Banking Expert Yevhen Dubohryz and was moderated by CASE Ukraine Director Dmytro Boyarchuk.

Keynote points of the discussion and abridged expositions of speaker reports are published below.

Keynote points (30 sec reading):

Base rate makes a poor monetary instrument during the war. The key monetary instrument today is administrative restrictions both on the foreign exchange market and on bank operation.

The banking system made it through the shock at the beginning of the war, banks are already returning NBU’s refinancing and private deposits are flowing into the banking system. Even banks in the regions with active hostilities are working seamlessly.

Liquidity is the key and only indicator for banks during the active war phase.

Banks have enough money to actively lend to businesses.

The NBU has considerably relaxed bank operations at the beginning of the war. The banks, in return, have to fairly report indicators with their real financial condition. Whatever losses resulting from the war, these should not be hidden without manipulating reports.

Banks are businesses too and so, also have to make profits. Banks lend – and will lend – to those businesses that have chances of success or those supported by the State via its programmes.

After the war, the NBU will return to its regular monetary policy of inflation targeting regime, flexible exchange rate, and will be cancelling administrative restrictions step by step.

Transcript of discussion (full video is here)

– What Condition Is Economy in Now? How Is It Working Now?

Serghiy Nikolaychuk: It would be a challenge now to demand aggregated assessments macroeconomists have been used to. The NBU relies more on microeconomic assessments, business surveys and observations using multiple micro indicators.

We see the Ukrainian population and businesses have started to come to senses and adapt to the new reality after the initial shock of the first two weeks.

Normal operation of the banking system helps the economy to adapt to the war. One example is the start of the sowing campaign, which is already full steam in 21 Oblast, including the Sumy and Kharkiv ones. The sowing has been to a slow start this year, first of all, due to weather conditions. Surely, the hostilities have added too.

Many are concerned with the logistics of agrarian and metal exports. The shifting away from the non-functioning ports goes on today; while the grain export potential made 600 thousand ton a month in March (vs. 5 to 6 million tons in the pre-war time), already in early April the per-month export capacities stand at 1 million ton. In the coming weeks, the capacities will be expanded to 1.5 million ton.

This has become possible due to transportation volume increase by Ukrzaliznytsia (the national railroad carrier) and new ‘green corridors’ set up between Ukraine and Poland. Also, negotiations on exports via European ports and specifically, via the Constanza port in Romania continue.

Regions freed from russian invaders are coming back to life.

The power supply system, an important component of economy functioning, operates steadily. The food industry is commissioning new production capacities on territories without active hostilities where there is a stable demand? both inside the country and abroad. Individual metallurgical plants are restoring their production and exports, and the logistics is reconsidered. Many metallurgical and machine-building enterprises are now re-orienting themselves to fit into war-time conditions and respective demand for individual products.

– What Are the Prospects of the Banking System During Hostilities?

Serghiy Nikolaychuk:

First of all, the banks quite successfully passed this war test. The NBU, together with the banks, have prepared action plans for various scenarios even without hopes of them to be implemented. As a result, even in these circumstances the banks continue operating, timely performing their obligations of servicing both legal entities and natural persons, issuing loans to economy agents and providing their services across the whole territory of Ukraine, even in areas of active combat action. The banks keep preparing new plans so, to my mind, the continuity of their operation will undoubtedly be ensured.

At this time, the banks receive much less revenues than due; some of their loan portfolio will be lost and its quality will deteriorate, which will negatively affect both banks’ lending facilities and equity. However, in NBU’s view and from our communications with banks, they will have to continue operating, even if their capital performance indicators are less than established standards.

For this, we changed our regulatory framework initiating amendments to the legislation which makes it impossible to implement corrective actions in the event of violation by banks of regulatory requirements (e.g., capital and adequacy requirements). That way we have ensured banks’ lending capacities even in loss-making circumstances. Our plan is to provide financial institutions with enough time to bring their operations back to normal and reinstate respective capital stock after the war ends.

At the very beginning of the war, the National Bank made a number of steps to simplify bank operations in the wartime, to support their financial condition and lending capacity. It specifically allowed the banks to implement repayment holiday option, which has been extensively used by banks since then. We have allowed the banks to ignore loan delinquency when underwriting. We have also provided them with the right to restructure loans linked to financial hardships of the borrower (due to the russian invasion) without claiming loan default. This creates flexible conditions for the banks to work with their customers and look for optimal schedule and terms and conditions of debt servicing.

Our communication with banks is based on the premise that banks must honestly reflect their real financial condition in the performance indicators. Whatever the losses because of the war, these cannot be concealed by fiddling with reports. It is important to see the real picture because without the one it will be quite difficult to implement an efficient plan of banking system recovery after the war.

We have allowed banks to assess credit risk by counterparty banks without regard to their compliance with economic standards set by the National Bank. That way, the banks will be able to rather flexibly manage their activities and operate in the current conditions. However, after the war the NBU will gradually return the banking system regulation back to normal. The NBU’s reforms of banking regulation that were launched in 2015 allowed the Ukrainian banks to face the war in a condition that allows them to provide extra resource rather than being a handicap to economic recovery.

Yevhen Dubohryz:

Before the war, the National Bank was widely criticised for the high liquidity the banks had; it is necessary to lend to everyone, “with good borrowers no more, let us lend to one and all.” However, in the past few years the National Bank has never changed the overall course nor has it been allowing banks to give away depositors’ money without supervision; that has helped the system to stay afloat.

– What Are the Most Challenging ‘Frontline’ Segments in the Banking Sector?

Yevhen Dubohryz:

There are two main bank characteristics in the banking supervision: the liquidity, or the ability to settle with customers here and now, to provide funds; and the solvency, or the ability to do the above for a long time, to remain operationally independent, to earn and fulfil all obligations for several or many years.

During the war, the second component, which is about solvency, is not the subject of attention at all. These days when there is no clarity as to how long the war will last and in which condition the economy will be at its end, all our banks are conditionally insolvent. What the losses will be is anyone’s guess. Therefore, the liquidity becomes the primary – and the only – priority.

There is no problem with it.

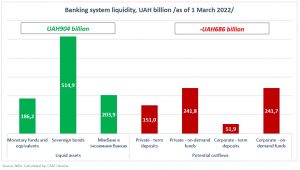

Situation with banking system liquidity one week into the war.

This chart shows what will happen in a completely catastrophic scenario when the banks will have lost 60% of all deposits and 50% of all money of businesses. It is an unrealistic, a rather hypothetical scenario. We had a much smaller outflow of business funds in March, and there was even an influx of private deposits. Even if this scenario were made reality, the banks still have had enough free resources at the start of the war and have now – the funds that can compensate for even such a catastrophic and hypothetical outflow of liquidity.

The real picture is much better. The current situation with cash outflow is even slightly better than it was in early March; lots of private money have returned to the system (note: + UAH66 billion in March, or +15% to the level at the start of the war). There is a slight outflow of corporate funds.

At the level of the banking system, we will not have any problems with liquidity for at least six months; the banks have the resources to fully settle with depositors.

Four banks are facing high and three, simple liquidity risk. For firsts, these are the banks that had either a retail lending model (that is, were focused on consumer loans (almost none of them are currently serviced) or, secondly, those who had their main business in war-affected areas.

The banks have resources to lend. There is also a desire on the part of the government to support through modifications of 5-7-9 loan facilities as well as interest compensation at government’s expense, that is, the introduction of state guarantees for loans.

– Why Banks Won’t Lend Just Everyone?

Yevhen Dubohryz:

It is important to remember that banks are businesses too. Often, we tend to forget that banks also need to make money. Therefore, the lending will now be channelled to the areas where partial or full loan guarantees and interest compensations are provided by the government. These are primarily the agriculture, logistics sectors and export industries. Here, the lending does not apply to crisis levels: it will be at the level sufficient to support the economy and serve mostly as the working capital. When it comes to investment lending, one should not expect a quick recovery.

Serghiy Nikolaychuk:

Banks are also businesses willing to live. Banks are now lending – and will lend – to businesses with a chance of success, or those that will be supported by the government through its programs. For example, sowing lending programs or 5-7-9 to support small and medium business.

Due to resource constraints, the governmental support is currently focussed on areas deemed by the government critical for the functioning of its own economy. It is currently the agricultural sector (food security of the country), the power sector, the logistics one – the areas that have become priority ones during the war. In my opinion, construction lending will be actively discussed already in the post-war period.

Each bank has its own situation and each loan may have its own specifics but the general message we convey to the banks is that without lending the economy will recover very slowly and that, on the other hand, the banks themselves will also benefit from the recovery of our economy.

– What Monetary Policy Principles is NBU Introducing in Wartime Conditions?

Serghiy Nikolaychuk:

In wartime conditions we have been forced to abandon the classic, orthodox monetary policy aimed at: managing inflation processes and targeting the inflation via interest rates. Specifically, the NBU Monetary Policy Committee has kept the 10% rate because we did not want to pretend we are living in normal conditions.

We are well aware that the main monetary instrument is administrative restrictions, the restrictions on both the FX market and on bank operation. We will continue using these tools to ensure macro-financial stability.

Some Bank Customers Ask Questions About Fees Payable on Overdraft Money Drawn Before the War: No Repayment Holidays, And the Interest Still Accrues. Are There Any Programs to Refinance Such Debt?

Serghiy Nikolaychuk:

The NBU has provided the banks with tools to introduce repayment holidays and, in particular, to disregard loan delinquency at credit risk assessment.

The regulatory body cannot review each case separately. The banks are independently solving the matters offering repayment holidays to the debtors who really need them.

On the other hand, many businesses in Western Ukraine continue to operate at the pre-war level. In our opinion, they should support the banking system and continue to service their loans.

Early in the war, the National Bank introduced unsecured refinancing, a tool aimed at combating the outflow of private and corporate deposits. More precisely, it is about offsetting the outflow of deposits that was observed in the first week. At this point there is no problem with the liquidity of the banks. Unsecured refinancing is almost never used by the banks which are actively repaying the loans they took in the first and second weeks of the war.

– What Will Happen to Fx rates?

Serghiy Nikolaychuk:

From the start of the war, we moved to a fixed Fx rate. We will continue using this currency exchange regime in the nearest future. Already after the war, we will gradually return to national monetary policy standards that involve inflation targeting regime, flexible Fx rate and step-by-step lifting of administrative restrictions.

– Is There a Possibility to Provide Banks with Resources to Reduce Current Interest on Existing Loans?

Serghiy Nikolaychuk:

This is already happening through government programs: flat interest rates have been imposed on loans for the sowing campaign and preferential interest rates have been set for 5-7-9 programs to allow for transfer of the most of the interest-paying burden from businesses onto the government.

– What Is the Situation with The Banks That Fail to Fulfil the Obligation to Return Deposits to Legal Entities? Is It a Systemic Problem? How Does the National Bank React to It in Martial Law Conditions?

Serghiy Nikolaychuk:

There is no systemic problem here. As I have already mentioned, the banks are fulfilling their obligations before customers, both legal entities and natural persons, and when isolated cases emerge, we try solving the issue as soon as possible.