What should be done after the Russian aggression is over?” debate. Participants in the debate were: Prof. Sergei Guriev, Rector (Provost) of Sciences Po in Paris, PhD Jan Hagemejer, Macroeconomics & Trade Director of CASE (Poland), and Prof. Tymofyi Mylovanov, president of the Kyiv School of Economics.

«Perspectives and Policy for Ukraine’s Post-war Economy. What should be done after the Russian aggression is over?» – a debate with international experts organized by the SGH Warsaw School of Economics and The CASE Centre for Social and Economic Research, under the umbrella of CIVICA Alliance.

Video

Transcript of Dmytro Boyarchuk’s speech:

First, I want to thank the Warsaw School of Economics for this opportunity to speak and present to this audience. I will be talking today about the report of the economic priorities in post-war Ukraine. What is this report about? I’m macro-level, we have developed the framework for understanding and dealing with Ukraine after the war ends. The report is a multi-layer product, and it covers almost all critical issues related to economic policy.

The report is very concentrated, an idea the very initiative came from Polish American Freedom Foundation. Polish American Freedom Foundation also was invested financially in this work. Ukrainian experts drafted the report, strong Ukrainian experts in their areas of expertise. And it was reviewed by people with recognized names like Leszek Balcerowicz, Ivan Mikloš, Anders Aslund, and Christopher Hartwell.

We’ll start with what Ukraine was like from an economic perspective before the war. We saw we had good achievements in various areas of life. We had good macro. It was macro-stabilization achieved. We had substantial progress with European integration. The remarkable point is related to strengthening the institutional capacity of the NBU. Land reform was launched – the hero of this story. And conducted decentralization. A lot has been done. We were slowly on the right path but have been moving in the right direction.

What happened after the war started? GDP plunged by 29.2%. Damage to infrastructure is estimated to be more than 140 billion dollars. Nearly 8 million Ukrainians left the country. The fiscal gap is huge – 27.5% of GDP in 2022. The war is still raging, and it’s unclear when the war might end. So the economy is seriously damaged.

At the same time, with the start of the war, several opportunities were opened. First of all, Ukraine received candidate status for EU membership. Brand Ukraine is recognized worldwide, and we hope that this brand will help us sell goods and services to the all world after the war ends. And the opportunity to build back better, but I would say this is the opportunity to build from scratch because you know that a lot of infrastructure we inherited from Soviet times. It could have been better quality, but now it’s a chance to create something new and much better.

How to get this opportunity? The official approach is basic – we harmonize our legislation with EU legislation. We need to find money for the development of the country. At first glance, it looks very simple and very clear. The problem is that for European integration, we must first establish the rule of law in the country.

As you know, that kind of harmonization of legislation is one of many challenges. The main challenge is to build fundamentals; as people say in the European Commission, all legislation is a kind of follow-up. So even if you harmonize legislation and your fundamentals need to improve, it will not count.

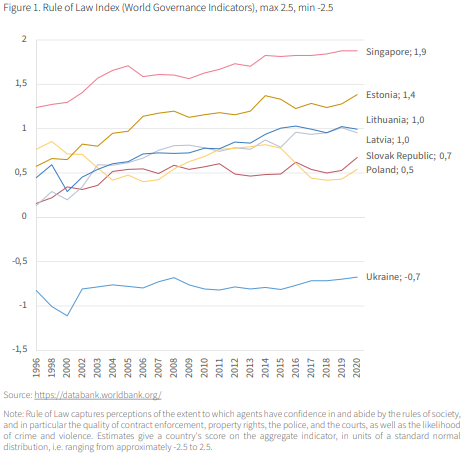

A related story to attract funding, both private and public funds. We again need a rule of law and good judicial and law enforcement systems. We have the rule of law in Ukraine, as you can see from this graph. This is data from the World Bank, World governance indicators – the rule of law index. You will see that situation with the rule of law in Ukraine changed very modestly over the last 30 years. I want to draw your attention to when Poland implemented their famous reforms in the early 90s the situation with fundamentals was much better than Ukraine had now in 2020. It’s a huge challenge for us to face over the upcoming years.

I will emphasize several points because, as I mentioned, the report is very concentrated. One of the report’s points is that we suggest developing numerical indicators to measure the progress in the judicial and law enforcement systems. Why so? The Western approach to the rule of law in the judiciary is that when you have a problem, you use only the law, and your problem is solved. But what to do if legislation doesn’t work? Then this case of legislation needs to be revised. That’s Ukrainian reality; there needs to be a better link between legislation and the implementation of this legislation into action. That’s why we propose to develop more numerical indicators to picture better what is going right and what is going wrong. They will be similar to these indicators of the World Bank, but more detailed and still need to be developed.

Another priority is simplification. We again talk about the rule of law when sophisticated legislation is applied to various specific cases. It is good because it’s more accurate in addressing specific issues. But this also means you will have more stories when taxpayers and the state have different views. If you have a lot of such stories, parties will need the service of the judicial system. When a judicial system is not very good, you are in a problem. That’s why we claim that Ukrainian legislation requires simplification to minimize the number of cases when the state, in the broad sense, might have a different view on the same situation as businesses and taxpayers. It’s a very important direction for the period while the rule of law is under construction. We understand that from this point until some point of success, the rule of law is in the progress of creation. While it is under construction, simplification is an important priority in stimulating economic growth, especially in small and medium enterprises.

What to do with attracting big, large private investments? Large private investments require two things when we talk about Ukraine. First of all, securitization of military risks. The second thing – is the securitization of relations with the state; this rule of law is also under construction. For military risks, the World Bank already suggests some mega tools. They have already raised some funding, and as far as I know, they have some pilot projects. But what about securitizing relations between private investors and the state? Main law enforcement bodies say in this case about law enforcement borders, but prosecutors and other people can endanger the activities of private investors. These relations should be securitized and even collateralized. And we propose, for instance, to use potentially confiscated Russian assets to collateralize these relations. Because it will not work like an insurance market for ensuring risks, we need a lot of participants to create this pool, generate funds, and make this securitization. In this case, you will need some funds already available to stimulate early commerce. We are discussing early commerce investors entering the Ukrainian market to be protected on this side.

How might it work? We are talking about the macro view, and it could work in this way. Those funds could be confiscated from Russia. For sure, they could not be used for any needs except for those which are related to Ukraine’s reconstruction, to Ukraine rebuilding. Some of them could be used for collateralizing and, in case some regional prosecutors cause damage to private foreign investors, prove this case in foreign courts. This damage could be compensated at the expense of those funds. This may serve as an additional incentive for early commerce to the Ukrainian market after the war ends.

So, these are three key messages: first – the incentivizing rule of law, judicial system reform, second – simplification of legislation, third – securitizing relations between the state and the potential project investors.

The report also contains many other sections related to public administration reform and anti-corruption; it covers almost everything related to economic development. Again, I want to pay attention to the widely discussed Russian assets, which should be used for these three purposes. Firstly – to rebuild Ukraine; second – to stimulate additional incentives for Ukrainian authorities to run faster reforms in terms of establishing the rule of law; thirdly – they should help to build momentum to build some credibility for first commerce, first investors, which potentially will be coming to the Ukrainian market.