This is evidenced by data from the study “Comparative analysis of the fiscal effect of the use of tax evasion/avoidance tools in Ukraine in 2024,” conducted by experts from the Institute for Social and Economic Transformation, CASE-Ukraine, and the Economic Expert Platform.

According to a previous study (for 2023), losses from tax evasion schemes amounted to UAH 353.5-568 billion per year.

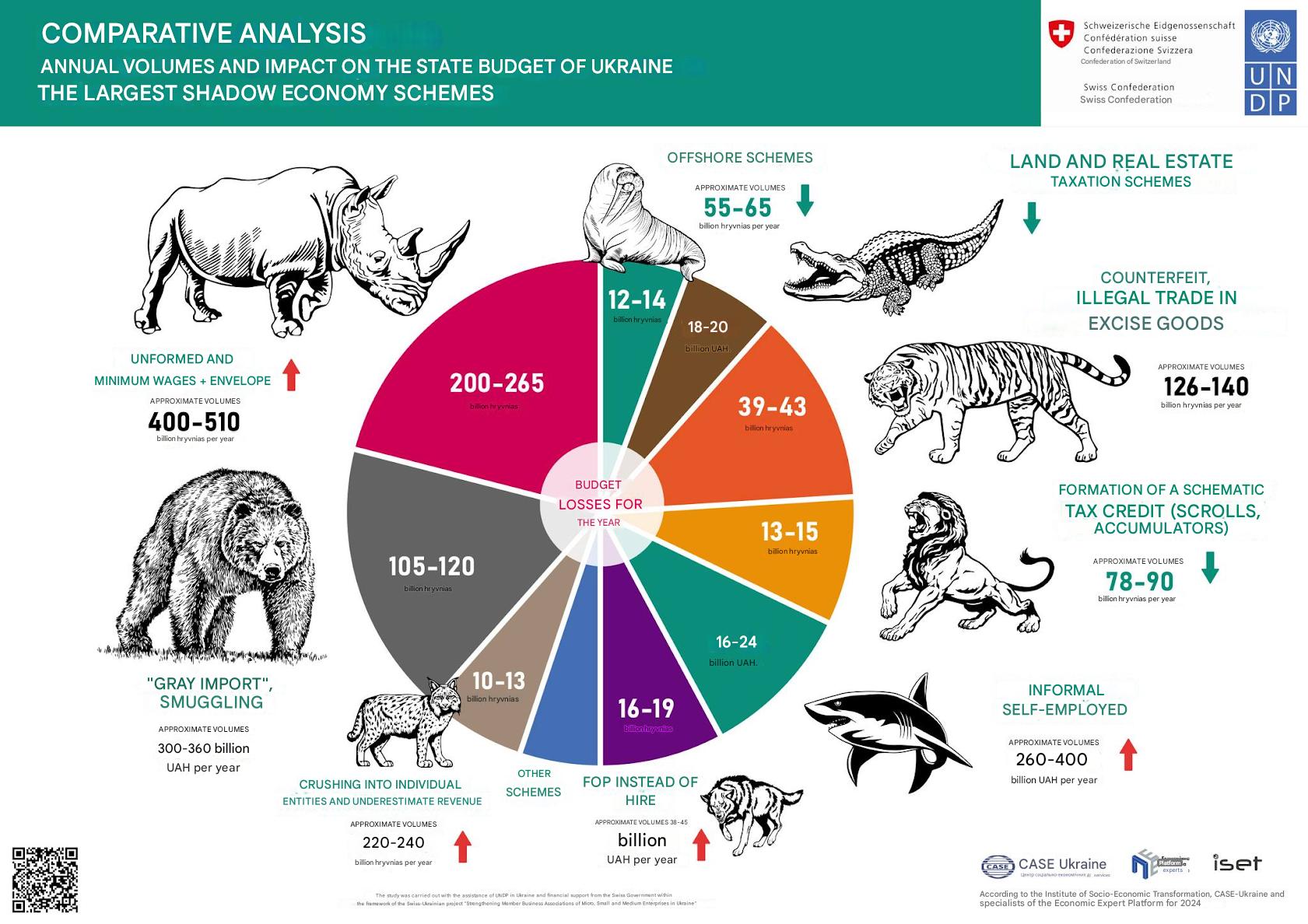

The leaders among the largest tax minimization schemes were schemes involving envelope wages (budget losses, according to new data, amounting to UAH 200-265 billion per year) and schemes involving smuggling and gray imports (UAH 105-120 billion per year). These two schemes confidently took the top spots and showed annual growth.

Offshore schemes and cross-border profit transfers due to currency restrictions and high servicing costs caused by new global tax transparency standards (antiBEPS, FATCA, ATAD, BEPS 2.0, CIC, and others) are increasingly becoming “elitist,” i.e., they remain accessible only to a few large Ukrainian companies and wealthy Ukrainians. The volume of profit flight abroad is at a historically low level.

Other popular tax evasion/avoidance tools show mixed trends. The introduction of administrative procedures, such as depositing funds in VAT accounts, a single register of tax invoices (elements of the VAT SEA) and an automatic monitoring system (SMKOR), has led to a reduction in the volume of tax credit schemes. In contrast, VAT avoidance schemes have not yet been eliminated.

There have also been positive developments in terms of budget losses due to schemes and incomplete land and real estate registers.

Positive trends are observed in combating the illegal circulation of counterfeit goods and illicit trade, which usually involves excise goods (alcoholic beverages, tobacco products, and petroleum products). The last two years have seen positive results in the de-shadowing of the alcohol and fuel markets, while the tobacco market has seen varying trends each quarter.

The most promising steps for a radical reduction of the shadow economy are significant improvements in administration, including the elimination of “envelopes” and a reform of the tax and customs services.

There is hope that, following the successful reboot of the BEB in 2025-2026, the systematic fight against “twists,” “envelopes,” and “gray” excise taxes, among others, will finally gain momentum and, over time, these phenomena will be eliminated. The process of rebooting the State Customs Service has also begun, which could potentially radically reduce the volume of “gray imports.”

However, the reboot of the State Tax Service has not yet been considered in Parliament, despite the draft law on this matter (No. 9243) having been pending for two years. Without this, it will be challenging to minimize large-scale schemes such as informal employment and trade, as well as VAT abuse (and, on the other hand, its burdensome administration). r