12 June 2023, Bruegel

The invasion of Ukraine has led to significant international efforts to assist the country in its recovery and ensure long-term stability. The international community recognizes Ukraine’s need for support in its post-war reconstruction and economic recovery. Recently, the International Monetary Fund (IMF) has approved a new Extended Fund Facility (EFF) arrangement of SDR 11.6 billion (about $15.6 billion) as part of a comprehensive $115 billion support package, providing a groundwork for a solid economic foundation and ensures Ukraine’s resilience.

This event featured discussions on the goals of the IMF’s New Extended Fund Facility for Ukraine and Dmytro Boyarchuk’s presentation on the main messages of the latest CASE report, «Economic Priorities in Post-war Ukraine.»

The speakers addressed vital priorities such as improving the rule of law, protecting property rights, and fostering private-sector competition, which are essential for reducing Russian influence and strengthening Ukraine’s economic independence.

Dmytro Boyarchuk

When we talk about the IMF program, this is what the country needs. If we did not have this support from other international actors, our path would be much more difficult. So this program is crucial for us. But I would like to stress one point. When we talk about saving or stabilizing Ukraine, that is one story. We also want to talk about growth and starting the engine of our changes, which is another story. That is what we have tried to address in our report.

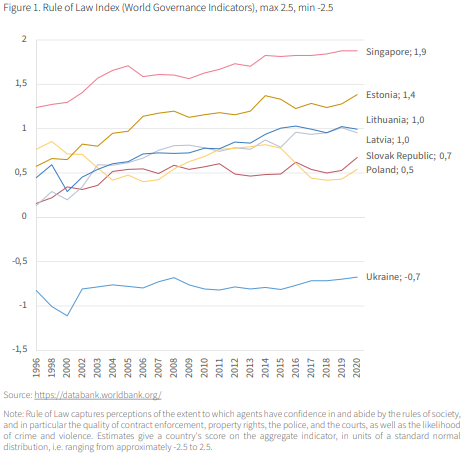

I want to draw your attention to this chart. This is the rule of law index from the World Bank’s World Governance Indicators. Сluster of lines at the top of the graph is the rule of law index for countries like Poland, the Slovak Republic, and the Baltic States. Countries that had impressive reform records in the 1990s. The line at the bottom, in the negative zone, is the rule of law in Ukraine. What does this chart tell us?

Firstly, the rule of law in Ukraine has not improved much in the last 30 years. We have made significant progress in many other areas of economic reform, but not here. Now we are just beginning to work on the rule of law.

The second point is that you can see that the Eastern European countries that showed impressive reform results in the early 1990s already had a functioning institutions. It may have been weak, it may not have been perfect, but they were able to build on that foundation to achieve awe-inspiring results. That is not the case in Ukraine; even in 2020, the rule of law situation is much worse than in Poland in the early 1990s. The question arises – if the rule of law was weak in Poland and the Baltic States in the 1990s, can the same be said about the situation in Ukraine in 2020? I would say it would be wrong to diagnose the problem this way. In our report, we call it suboptimal and unreliable. Because you can not rely on this institution when building your policies and your economic policies, we have this history that even the authorities do not depend on this institution, particularly when making their tax and customs administration.

The critical question in this story is how Ukraine can develop and prosper in these years when the rule of law is still being built. We see a lot of attention to this story, a lot of attention to the rule of law. Reform is moving forward, we have many steps, but at the same time, we understand that it will take years for this institution to work. How do we get the engine of economic growth going if an essential component of the success of Western countries, the most important institution, is not involved? That is the question we try to answer in our report. It is very concentrated and has many components. One of the answers we propose is to simplify economic policy. If you have complex legislation, it is much better than simple legislation. It solves particular problems very precisely, but it also creates a tendency for a taxpayer and a government agency to have different views on the same situation. In such cases, you need the services of the judiciary. If your judicial and law enforcement systems are not sound, you will have problems. So you need to minimize the cases where the state and the taxpayer interpret the same situation differently.

As specific proposals in taxation, we claim that such practices as the presumption of guilt in tax and customs administration should be revised. What is the idea of guilt? Very uncomfortable when I say this to people in Western communities because if you’ve never experienced it, you can’t even imagine how it works. The closest example is the visa process. When I want to come to the UK, I apply for a visa because I’m suspected of having intentions to stay here illegally, and I have to provide documentation to prove that this risk is minimal. This is how it works with every Ukrainian tax and customs administration transaction. It’s very arbitrary, and it allows intervention at every stage of the operation of businesses; it creates massive dissatisfaction among companies regarding how it works. But the state doesn’t trust the judicial and law enforcement systems.

How it works in Western society. Fiscal discipline is based on the certainty of punishment. If you break the law, you know that you are likely to be punished. This keeps everything within a particular discipline. In Ukraine, it’s different: if you succeed in evading taxes, the probability that law enforcement and the judiciary will catch and punish you is very low. That is why the government has developed a system based on the presumption of guilt, where every taxpayer has to submit documents for almost every transaction to prove that they do not intend to evade taxes. This system may help to collect taxes, but it is very destructive to the economy. This is just one example of simplification.

Unfortunately, discussing an international organization goes beyond international organizations because national governments decide how to maintain this fiscal discipline.

This is one of the most painful stories. When I talk to representatives of Ukraine and businesses, I hear various proposals, such as the abolition of VAT and other stories. But the rule of law is the main problem, the primary pain.