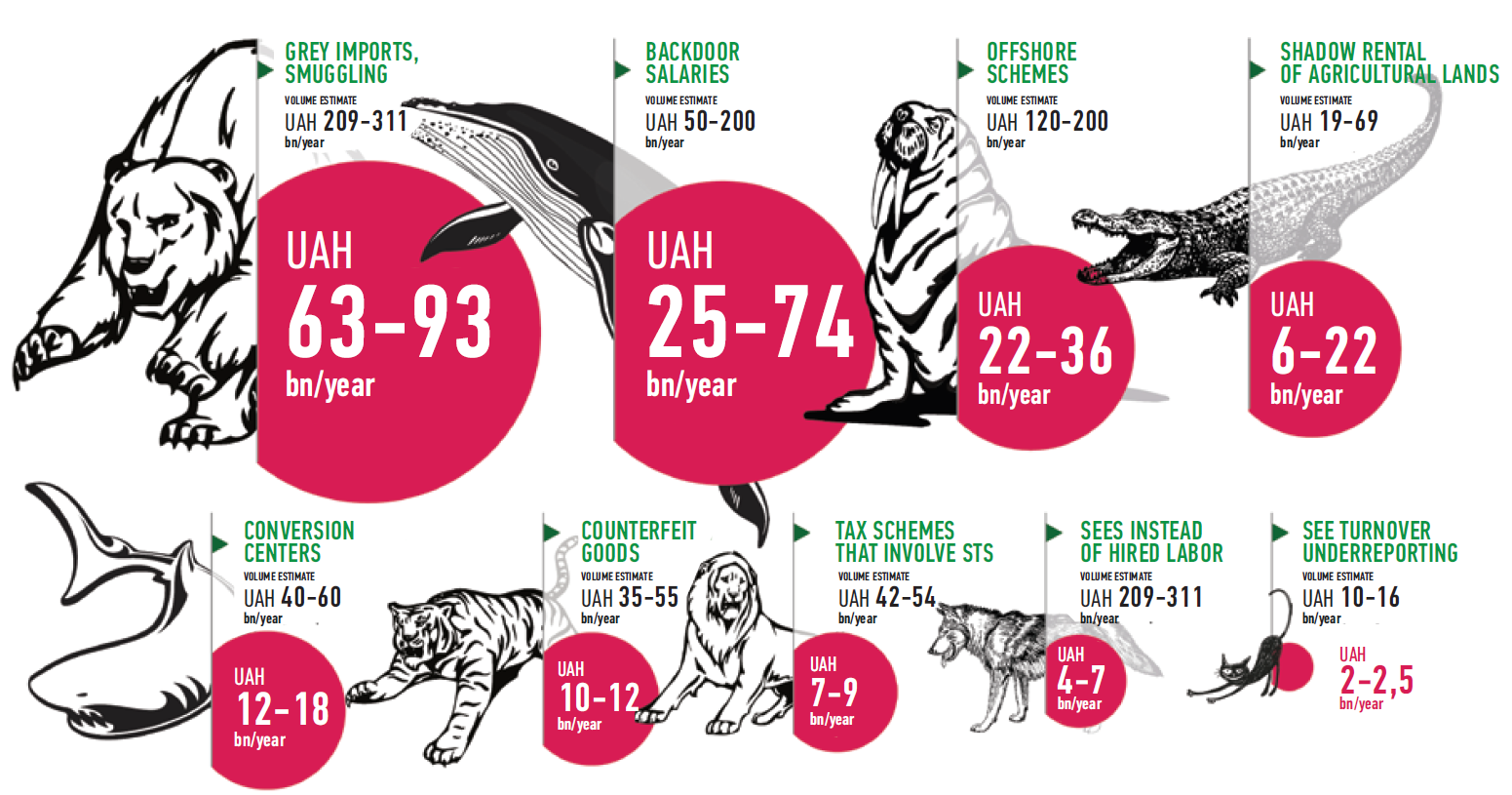

As in most developing countries, Ukraine’s state budget suffers from the shadow economy. But the structure of tax avoidance is atypical compared to most other countries. In particular, in contrast to developed countries, in Ukraine large and very large enterprises, have more opportunities to evade paying taxes en masse. However, the set of tax avoidance instruments itself is largely similar to other countries. The most common are: violation of customs rules and smuggling, offshore schemes, “counterfeiting”, theft of value added tax, shadow lease of agricultural land, the activities of “conversion centers”. Violations of customs rules, smuggling and corruption at the border in recent years have outperformed the offshore systems as the first in a rank by incurring annual losses of the budget revenues in the amount of 63 to 93 billion UAH. Another challenge for the tax system in recent years has been counterfeiting – the production and sale of counterfeit goods without paying excise tax. Annually, the budget loss from this phenomenon is about 10-12 billion UAH. The state budget loses the least from using the pseudo sole proprietors (UAH 4-7 billion) instead of employees, and understatement of the sole proprietors’ revenues (UAH 2-2.5 billion per year). This study assesses the scope of the most common instruments of tax evasion in Ukraine and estimates the budget losses from them. The report also contains recommendations for increasing revenues to the state budget of Ukraine.

To download the research please click on the image below: